About 'bad debts written off'|Writing of Bad Debts: Commercial judgment given primacy

I. OVERVIEW In the wake of the September 11 terrorist attacks on the USA, attention was drawn to the age-old, secretive, and globe-spanning banking system developed in Asia and known as "Hawala" (to change, in Arabic). It is based on a short term, discountable, negotiable, promissory note (or bill of exchange) called "Hundi". While not limited to Moslems, it has come to be identified with "Islamic Banking". Islamic Law (Sharia'a) regulates commerce and finance in the Fiqh Al Mua'malat, (transactions amongst people). Modern Islamic banks are overseen by the Shari'a Supervisory Board of Islamic Banks and Institutions ("The Shari'a Committee"). The Shi'a "Islamic Laws according to the Fatawa of Ayatullah al Uzama Syed Ali al-Husaini Seestani" has this to say about Hawala banking: "2298. If a debtor directs his creditor to collect his debt from the third person, and the creditor accepts the arrangement, the third person will, on completion of all the conditions to be explained later, become the debtor. Thereafter, the creditor cannot demand his debt from the first debtor." The prophet Muhammad (a cross border trader of goods and commodities by profession) encouraged the free movement of goods and the development of markets. Numerous Moslem scholars railed against hoarding and harmful speculation (market cornering and manipulation known as "Gharar"). Moslems were the first to use promissory notes and assignment, or transfer of debts via bills of exchange ("Hawala"). Among modern banking instruments, only floating and, therefore, uncertain, interest payments ("Riba" and "Jahala"), futures contracts, and forfeiting are frowned upon. But agile Moslem traders easily and often circumvent these religious restrictions by creating "synthetic Murabaha (contracts)" identical to Western forward and futures contracts. Actually, the only allowed transfer or trading of debts (as distinct from the underlying commodities or goods) is under the Hawala. "Hawala" consists of transferring money (usually across borders and in order to avoid taxes or the need to bribe officials) without physical or electronic transfer of funds. Money changers ("Hawaladar") receive cash in one country, no questions asked. Correspondent hawaladars in another country dispense an identical amount (minus minimal fees and commissions) to a recipient or, less often, to a bank account. E-mail, or letter ("Hundi") carrying couriers are used to convey the necessary information (the amount of money, the date it has to be paid on) between Hawaladars. The sender provides the recipient with code words (or numbers, for instance the serial numbers of currency notes), a digital encrypted message, or agreed signals (like handshakes), to be used to retrieve the money. Big Hawaladars use a chain of middlemen in cities around the globe. But most Hawaladars are small businesses. Their Hawala activity is a sideline or moonlighting operation. "Chits" (verbal agreements) substitute for certain written records. In bigger operations there are human "memorizers" who serve as arbiters in case of dispute. The Hawala system requires unbounded trust. Hawaladars are often members of the same family, village, clan, or ethnic group. It is a system older than the West. The ancient Chinese had their own "Hawala" - "fei qian" (or "flying money"). Arab traders used it to avoid being robbed on the Silk Road. Cheating is punished by effective ex-communication and "loss of honour" - the equivalent of an economic death sentence. Physical violence is rarer but not unheard of. Violence sometimes also erupts between money recipients and robbers who are after the huge quantities of physical cash sloshing about the system. But these, too, are rare events, as rare as bank robberies. One result of this effective social regulation is that commodity traders in Asia shift hundreds of millions of US dollars per trade based solely on trust and the verbal commitment of their counterparts. Hawala arrangements are used to avoid customs duties, consumption taxes, and other trade-related levies. Suppliers provide importers with lower prices on their invoices, and get paid the difference via Hawala. Legitimate transactions and tax evasion constitute the bulk of Hawala operations. Modern Hawala networks emerged in the 1960's and 1970's to circumvent official bans on gold imports in Southeast Asia and to facilitate the transfer of hard earned wages of expatriates to their families ("home remittances") and their conversion at rates more favourable (often double) than the government's. Hawala provides a cheap (it costs c. 1% of the amount transferred), efficient, and frictionless alternative to morbid and corrupt domestic financial institutions. It is Western Union without the hi-tech gear and the exorbitant transfer fees. Unfortunately, these networks have been hijacked and compromised by drug traffickers (mainly in Afganistan and Pakistan), corrupt officials, secret services, money launderers, organized crime, and terrorists. Pakistani Hawala networks alone move up to 5 billion US dollars annually according to estimates by Pakistan's Minister of Finance, Shaukut Aziz. In 1999, Institutional Investor Magazine identified 1100 money brokers in Pakistan and transactions that ran as high as 10 million US dollars apiece. As opposed to stereotypes, most Hawala networks are not controlled by Arabs, but by Indian and Pakistani expatriates and immigrants in the Gulf. The Hawala network in India has been brutally and ruthlessly demolished by Indira Ghandi (during the emergency regime imposed in 1975), but Indian nationals still play a big part in international Hawala networks. Similar networks in Sri Lanka, the Philippines, and Bangladesh have also been eradicated. The OECD's Financial Action Task Force (FATF) says that: "Hawala remains a significant method for large numbers of businesses of all sizes and individuals to repatriate funds and purchase gold.... It is favoured because it usually costs less than moving funds through the banking system, it operates 24 hours per day and every day of the year, it is virtually completely reliable, and there is minimal paperwork required." (Organisation for Economic Co-Operation and Development (OECD), "Report on Money Laundering Typologies 1999-2000," Financial Action Task Force, FATF-XI, February 3, 2000, at http://www.oecd.org/fatf/pdf/TY2000_en.pdf ) Hawala networks closely feed into Islamic banks throughout the world and to commodity trading in South Asia. There are more than 200 Islamic banks in the USA alone and many thousands in Europe, North and South Africa, Saudi Arabia, the Gulf states (especially in the free zone of Dubai and in Bahrain), Pakistan, Malaysia, Indonesia, and other South East Asian countries. By the end of 1998, the overt (read: tip of the iceberg) liabilities of these financial institutions amounted to 148 billion US dollars. They dabbled in equipment leasing, real estate leasing and development, corporate equity, and trade/structured trade and commodities financing (usually in consortia called "Mudaraba"). While previously confined to the Arab peninsula and to south and east Asia, this mode of traditional banking became truly international in the 1970's, following the unprecedented flow of wealth to many Moslem nations due to the oil shocks and the emergence of the Asian tigers. Islamic banks joined forces with corporations, multinationals, and banks in the West to finance oil exploration and drilling, mining, and agribusiness. Many leading law firms in the West (such as Norton Rose, Freshfields, Clyde and Co. and Clifford Chance) have "Islamic Finance" teams which are familiar with Islam-compatible commercial contracts. II. HAWALA AND TERRORISM Recent anti-terrorist legislation in the US and the UK allows government agencies to regularly supervise and inspect businesses that are suspected of being a front for the ''Hawala'' banking system, makes it a crime to smuggle more than $10,000 in cash across USA borders, and empowers the Treasury secretary (and its Financial Crimes Enforcement Network - FinCEN) to tighten record-keeping and reporting rules for banks and financial institutions based in the USA. A new inter-agency Foreign Terrorist Asset Tracking Center (FTAT) was set up. A 1993 moribund proposed law requiring US-based Halawadar to register and to report suspicious transactions may be revived. These relatively radical measures reflect the belief that the al-Qaida network of Osama bin Laden uses the Hawala system to raise and move funds across national borders. A Hawaladar in Pakistan (Dihab Shill) was identified as the financier in the attacks on the American embassies in Kenya and Tanzania in 1998. But the USA is not the only country to face terrorism financed by Hawala networks. In mid-2001, the Delhi police, the Indian government's Enforcement Directorate (ED), and the Military Intelligence (MI) arrested six Jammu Kashmir Islamic Front (JKIF) terrorists. The arrests led to the exposure of an enormous web of Hawala institutions in Delhi, aided and abetted, some say, by the ISI (Inter Services Intelligence, Pakistan's security services). The Hawala network was used to funnel money to terrorist groups in the disputed Kashmir Valley. Luckily, the common perception that Hawala financing is paperless is wrong. The transfer of information regarding the funds often leaves digital (though heavily encrypted) trails. Couriers and "contract memorizers", gold dealers, commodity merchants, transporters, and moneylenders can be apprehended and interrogated. Written, physical, letters are still the favourite mode of communication among small and medium Hawaladars, who also invariably resort to extremely detailed single entry bookkeeping. And the sudden appearance and disappearance of funds in bank accounts still have to be explained. Moreover, the sheer scale of the amounts involved entails the collaboration of off shore banks and more established financial institutions in the West. Such flows of funds affect the local money markets in Asia and are instantaneously reflected in interest rates charged to frequent borrowers, such as wholesalers. Spending and consumption patterns change discernibly after such influxes. Most of the money ends up in prime world banks behind flimsy business facades. Hackers in Germany claimed (without providing proof) to have infiltrated Hawala-related bank accounts. The problem is that banks and financial institutions - and not only in dodgy offshore havens ("black holes" in the lingo) - clam up and refuse to divulge information about their clients. Banking is largely a matter of fragile trust between bank and customer and tight secrecy. Bankers are reluctant to undermine either. Banks use mainframe computers which can rarely be hacked through cyberspace and can be compromised only physically in close co-operation with insiders. The shadier the bank - the more formidable its digital defenses. The use of numbered accounts (outlawed in Austria, for instance, only recently) and pseudonyms (still possible in Lichtenstein) complicates matters. Bin Laden's accounts are unlikely to bear his name. He has collaborators. Hawala networks are often used to launder money, or to evade taxes. Even when employed for legitimate purposes, to diversify the risk involved in the transfer of large sums, Hawaladars apply techniques borrowed from money laundering. Deposits are fragmented and wired to hundreds of banks the world over ("starburst"). Sometimes, the money ends up in the account of origin ("boomerang"). Hence the focus on payment clearing and settlement systems. Most countries have only one such system, the repository of data regarding all banking (and most non-banking) transactions in the country. Yet, even this is a partial solution. Most national systems maintain records for 6-12 months, private settlement and clearing systems for even less. Yet, the crux of the problem is not the Hawala or the Hawaladars. The corrupt and inept governments of Asia are to blame for not regulating their banking systems, for over-regulating everything else, for not fostering competition, for throwing public money at bad debts and at worse borrowers, for over-taxing, for robbing people of their life savings through capital controls, for tearing at the delicate fabric of trust between customer and bank (Pakistan, for instance, froze all foreign exchange accounts two years ago). Perhaps if Asia had reasonably expedient, reasonably priced, reasonably regulated, user-friendly banks - Osama bin Laden would have found it impossible to finance his mischief so invisibly. |

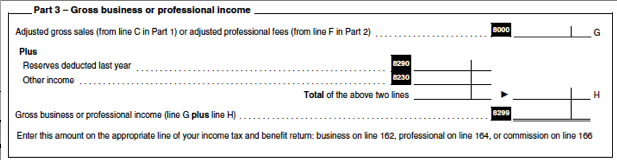

Image of bad debts written off

bad debts written off Image 1

bad debts written off Image 2

bad debts written off Image 3

bad debts written off Image 4

bad debts written off Image 5

Related blog with bad debts written off

- indiacorplaw.blogspot.com/... to write off sticky interest as described above, and write off actual bad debts, the question arises as to when debt may be considered bad...

- quickbooksblog.blogspot.com/...who would know who owes what. This will give you a starting point. To write off bad debt follow these instructions from the QuickBooks Help Menu: 1...

- lewisbusiness.blogspot.com/The above screencast demonstrates how to write off bad debts in MYOB. Full instructions along with more screencast tutorials will...

- officehowto.blogspot.com/Writing off bad debts in MYOB involves ...itself by default) and record in order to write of this bad debt. That's all there is to it...

- imosque.wordpress.com/Circular 003-09 Procedure to Write Off Bad Debts February 17, 2009 This circular shall address the numerous questions on bad debts...

- economics102.wordpress.com/...borrow. Thus if there were to be a write off of debt it would probably end up on individual... going to get a haircut or worse, so it might be less painful if it...

- legaldevelopments.blogspot.com/...irrecoverable before it can be written off as a bad debt; or is it enough if...It is enough if the bad debt is written off as irrecoverable in the ...

- timnovate.wordpress.com/... did not make the bad decisions. The banks did. So we have to write off the debt. As someone has said, debt...

- beritaheboh.wordpress.com/Lower the payments on your Debt. Money Yogi can help. trac-ads.com More on debt consolidation: www.solvemybadcredit.co.uk Share this: StumbleUpon Digg Reddit

- crofsblogs.typepad.com/...Nova Scotia writes off $2.1-M student debt . Excerpt: Nova Scotia has written off $2.18-million in bad student debts, a figure student leaders say is the latest sign graduates...

Bad Debts Written Off - Blog Homepage Results

... for Kids My Amazon Store for Parents NaNoWriMo (aka National Novel Writing Month) Our Consulting Team Prosperity for Kids What Kids Need to...

<>by

... Friday evening,” he wrote this morning. “His appearance was ... or even raising the debt limit at all. The situation has held...

ruthymcby

...especially since I’m always half-crocked when I write it. http://retroroxy.wordpress.com/ Reply Roxy... via email. AfterNew year…..worse me? January 1, 2011 » About This...

Related Video with bad debts written off

bad debts written off Video 1

bad debts written off Video 2

bad debts written off Video 3

0 개의 댓글:

댓글 쓰기