About 'bad debt written off'|Writing Off Bad Debt.

It is very important to note that there is a difference between first party and third party collections. First party collections take place when the lenders themselves attempt to collect on a debt. There are some federal laws that apply to this these collectors and some that may vary slightly from state to state, but the laws surrounding first party debt collection attempts relatively fall into a gray area, allowing them to follow some different practices than a third party collection agency. A third party debt collection agency is a company who has no direct affiliation with the debt or the debtor. Most lenders prefer to use a third party collection agency or will resort to using one after their own previous attempts at collecting against the debt have been unsuccessful. People have been asking themselves the question for years, "How do I get bill collectors off of my back?" What Third Party Debt Collectors are Not Allowed to Do. Third party debt collection agencies had strict rules that they must adhere to and failure to do so could result in fines, penalties, and even lawsuits against the company. Third party collection agencies are only allowed to contact debtors between the hours of 8am and 9pm, local time to the debtor. Third party debt collection agencies are not allowed to phone debtors at their place of employment if the debtor has notified the agency that the number they are dialing is indeed for their employer and that they could suffer disciplinary measures if the calls continue. Third party collection agents are not allowed to phone any number that the owner of the number has stated is a cellular number that would incur charges as a result of the call. The agency may ask that you send the request in writing. If they do, be sure to comply. Third party collection agents may speak only to the debtor, their spouse, and their power of attorney, as long as the agency has a POA letter on file for the debtor. Another exception to this law is if the debtor is a minor in their respective state. If the person answering the phone does not identify themselves as any of those people, the agency may leave a message for the debtor, but the message most not in anyway indicate that the company is a collection agency. For example, if the company name is Strategic Collections Incorporated, the agent may not give that name, but may simply say "SCI" and that they are calling in regards to "a personal business matter", for example. A third party collection center call agent typically is not allowed to contact the creditor directly. This means that because a customer says "But they said that they took care of that! Call 'Fink Shop Mart' and ask them!', that the collector simply cannot do so. It is a violation of privacy laws for the agent to do so. Collection agents may not use profane or threatening language towards a debtor. This is a huge "No-No" and is also a violation of law. Unfortunately, it is these kinds of unethical approaches and tactics that give good and ethical collection agents a bad rap. How to Get Rid of Annoying Debt Collectors Unfortunately, the best way to get rid of an annoying debt collector in regards to a valid debt is simply by paying the debt. Some collection agencies have arrangements with their clients that may allow for them to work with a debtor to collect a lower total lump sum payment or to set up a payment plan. Do not be surprised, however, if the agency does not. If you are uncertain about the bill, ask that the company send you a written notice of the debt. They must comply. Verify the validity of the information contained in the bill. If it is incorrect, call the company to notify them and be prepared to send them a written letter of dispute, highlighting why the information is incorrect. Be sure to make a copy of the letter for yourself and to send it certified mail with return receipt. If it appears to be an incident of identity theft or fraud, be prepared to send the company all legal documentation of the matter including a copy of the police report or information concerning where the report is filed and the incident number of the report. If you desire for phone communications to cease entirely, you must notify the company in writing that you would like for them to no longer contact you via telephone. Be sure to include any known open accounts with the company as well as your name and telephone number. The company may contact a debtor by phone at least one time, per reach received account. Be sure to make a copy of the letter to keep for your records and send the letter out by certified mail. The agency has thirty days to comply and update all accounts, current at the time, to reflect the change. What Else Should is There to Know? A collection agency phoning your number six times a day but receiving no answer does not constitute harassment charges. In order for calls to cease, they must first be notified that the debtor would like for them to stop, but it's impossible to do that without first speaking to the debtor or receiving written notice. A third party collection agency may legally contact others in an attempt to contact a debtor. This is known as skip tracing, and it is a legal practice. What is not legal, however, is a third party collection agent discussing the details of the debt to friends and relatives. For more information about the Fair Debt Collection Practices Act, visit the FTC's FDCPA page here. If you have been the victim of an abuse collection agency or agent, the FTC may be able to help you. Visit the Federal Trade Commission website to learn more. |

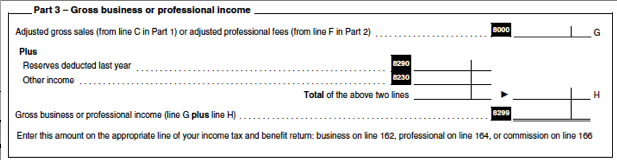

Image of bad debt written off

bad debt written off Image 1

bad debt written off Image 2

bad debt written off Image 3

bad debt written off Image 4

bad debt written off Image 5

Related blog with bad debt written off

- indiacorplaw.blogspot.com/... to write off sticky interest as described above, and write off actual bad debts, the question arises as to when debt may be considered bad...

- quickbooksblog.blogspot.com/...who would know who owes what. This will give you a starting point. To write off bad debt follow these instructions from the QuickBooks Help Menu: 1...

- lewisbusiness.blogspot.com/The above screencast demonstrates how to write off bad debts in MYOB. Full instructions along with more screencast tutorials will...

- officehowto.blogspot.com/Writing off bad debts in MYOB involves ...itself by default) and record in order to write of this bad debt. That's all there is to it...

- imosque.wordpress.com/Circular 003-09 Procedure to Write Off Bad Debts February 17, 2009 This circular shall address the numerous questions on bad debts...

- economics102.wordpress.com/...borrow. Thus if there were to be a write off of debt it would probably end up on individual... going to get a haircut or worse, so it might be less painful if it...

- legaldevelopments.blogspot.com/...irrecoverable before it can be written off as a bad debt; or is it enough if...It is enough if the bad debt is written off as irrecoverable in the ...

- timnovate.wordpress.com/... did not make the bad decisions. The banks did. So we have to write off the debt. As someone has said, debt...

- beritaheboh.wordpress.com/Lower the payments on your Debt. Money Yogi can help. trac-ads.com More on debt consolidation: www.solvemybadcredit.co.uk Share this: StumbleUpon Digg Reddit

- crofsblogs.typepad.com/...Nova Scotia writes off $2.1-M student debt . Excerpt: Nova Scotia has written off $2.18-million in bad student debts, a figure student leaders say is the latest sign graduates...

Bad Debt Written Off - Blog Homepage Results

... for Kids My Amazon Store for Parents NaNoWriMo (aka National Novel Writing Month) Our Consulting Team Prosperity for Kids What Kids Need to...

<>by

... Friday evening,” he wrote this morning. “His appearance was ... or even raising the debt limit at all. The situation has held...

ruthymcby

...especially since I’m always half-crocked when I write it. http://retroroxy.wordpress.com/ Reply Roxy... via email. AfterNew year…..worse me? January 1, 2011 » About This...

Related Video with bad debt written off

bad debt written off Video 1

bad debt written off Video 2

bad debt written off Video 3