About 'bad debt buyers'|8 Things We Learned From FTC Report On Debt-Buyers

In recent weeks credit rating agencies Moody's and Standard & Poor's have cautioned that the U.S. AAA credit rating may be downgraded unless a deficit-reduction plan is put in place in the range of $4 trillion in cuts. Today, S&P have indicated a 50 percent chance that the U.S. will be downgraded to a AA rating, perhaps as soon as this August. To small businesses in the United States this is bad news indeed. With the United States government currently paying $250 billion in interest a year, a downgrade in its credit rating will cause interest on U.S. debt to rise to as much as a trillion dollars a year. The U.S. government will have to shrink and redistribute revenues, or more likely tap producers for higher taxes. For small businesses, higher taxes mean less money to reinvest in the business. The second, hidden tax imposed through quantitative easing will effectively inflate the money supply to provide government with the cash it needs. This will lead to the erosion of savings and an overall price increase that will hit small businesses in the form of higher rents, rising production and transport costs, and higher operation and employee salaries, which in turn will force small businesses to reduce inventory and raise prices. As the economy shrinks under the burden of inflation and increased taxation, people will have less money to spend, and small businesses, which have a small buffer for economic downturns, will be hit hardest with higher costs and lower revenues. At this point, credit may help small businesses to stay afloat; however, if the U.S. credit rating is downgraded the yield on its bonds will have to rise to attract buyers of U.S. Debt. This, in turn, will affect the U.S. prime rate, which the Federal Reserve bases on 30-year bonds. When the prime rate will go up, so will all variable rates on U.S. credit cards and variable mortgages. For small businesses this means higher interest rates on business loans. Government spending today is at levels equal to WWII. This has put the country on an unsustainable path, with the government set to double its size in five years, or triple it in ten if the nation follows the President's budget. Several plans are currently being discussed to deal with the U.S. debt crisis. The McConnell plan proposes to bypass the Constitution and give the Executive Branch (the President) the power to raise the debt limit without reference to Congress, in which case the U.S. credit rating is sure to be downgraded, making credit less available to small businesses. The Gang of Six plan proposes to cut spending by $3.7 Trillion over 10 years (for which no specifics are available), but to increase taxes by $1.2 Trillion, which is sure to weaken small businesses who rely on money staying in the hands of individuals not bureaucrats. Finally, the only plan that is already a bill (which has passed in the House) is Cut, Cap and Balance. The bill proposes to cut $111 Billion in government spending in the first year alone and cut $6 Trillion over 10 years. Even more importantly for small businesses, the bill will cap government spending as a percentage of the economy. Finally, the bill includes a balance budget amendment to the constitution, which will include a spending limitation and a super-majority requirement for raising taxes, both of which will introduce a climate of certainty into the economy and help small businesses survive the financial turbulence of today and plan for a better future. More from this Contributor The Latest Online Marketing Trends for Small Business Selling Your Small Business for the Highest Price 5 Small Business Mistakes That Will Cost You |

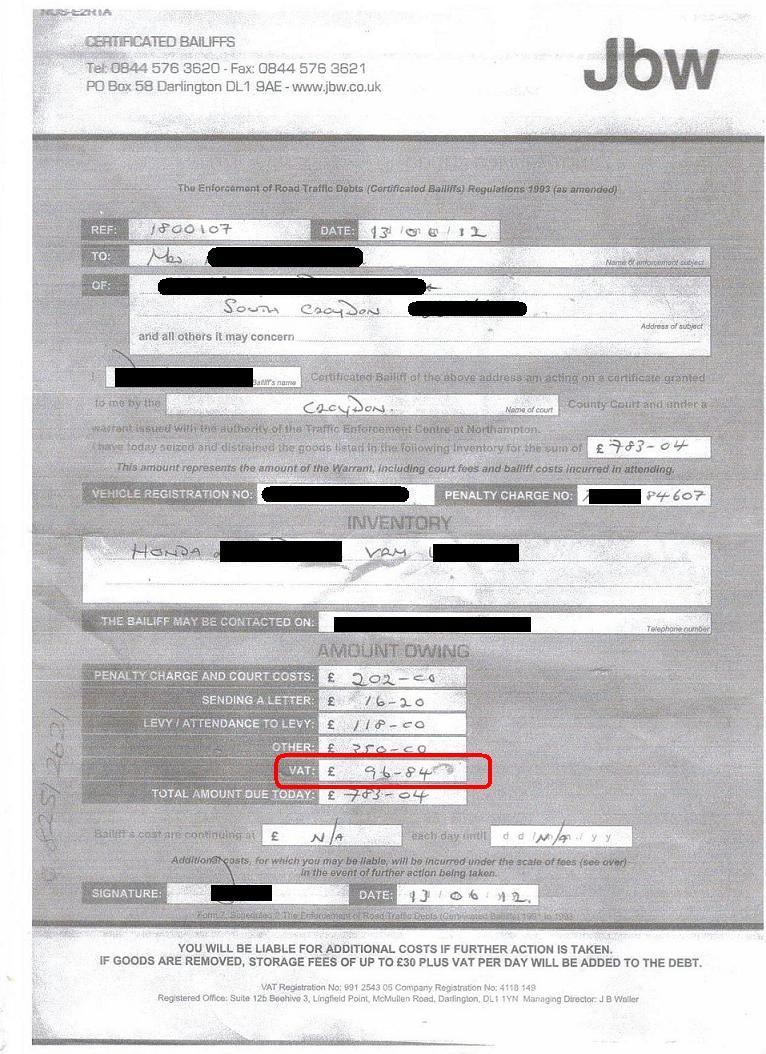

Image of bad debt buyers

bad debt buyers Image 1

bad debt buyers Image 2

bad debt buyers Image 3

bad debt buyers Image 4

bad debt buyers Image 5

Related blog with bad debt buyers

- suedfordebt.wordpress.com/...Wednesday, July 22nd, 2009 at 3:38 pm and is filed under Credit Card Debt , Debt Collection , Debt Collection Lawsuit , Personal Debt , Sued For Debt . You can follow...

- credit.typepad.com/...plus interest. They're junk debt buyers, and while their business isn...Problem is, a lot of debt buying firms..., they purchase old, bad debts that the original...

- credit.typepad.com/... by a junk debt buyer, there are a few ...collector must be able to prove the debt is legit by ...t enough. •Never Acknowledge a Bad Debt Like I said, don...

- homeequitytheft-cases-articles.blogspot.com/...each year. That’s why the agency recently completed a lengthy investigation into debt-buyers and why they do such a bad job. Specifically, the FTC wanted to know why debt-buyers, the ...

- whattaboutbob.blogspot.com/...the club. That's the way investing is supposed to work. Too bad most people don't know the secrets of H.L. Hunt. I'd like to send you all...

- dannlaw.wordpress.com/...Commission each year. That's why the agency recently completed a lengthy investigation into debt-buyers and why they do such a bad job. Read more… 1,104 more words

- openingmind.blogspot.com/...and the entire world has been deliberately pushed by design into a buyers market. There is another aspect of the Coming Fire Sale which I have ...

- democracyreform.blogspot.com/... and soaring public debt. If you look at the statistics, most of the OECD...about 5 per cent of GDP. Japan is even worse at more than 6 per cent of GDP. Some ...

- lidaifu.blogspot.com/...House of Zhao. When their money was finished, they soon got into debt. However, as their debts piled up, they tried to escape from their...

- harbinus.blogspot.com/...still a fall in energy prices would be bad for CESV, while a rise would be good. A final...stability of CESV is if some institutional buyers buy and hold some of the float. When I ...

Related Video with bad debt buyers

bad debt buyers Video 1

bad debt buyers Video 2

bad debt buyers Video 3