About 'bad debt expenses'|...of her departments expenses claim, where she intentionally... off a big debt or she had ... doing. I mean bad habits are...

Millions of consumers each year, especially young people, take credit cards up on their offers of credit cards. They often do not pay attention to interest rates and other related fees and the majority easily racks up thousands upon thousands of debt quite quickly. While filing Chapter 7 bankruptcy has provided the option for consumers to erase the debt they have amassed soon it will not be as easy. The tougher new bankruptcy laws that President Bush has just passed will focus more on creditors being repaid and make it more difficult for consumers filing for Chapter 7 bankruptcy. The new bankruptcy laws are causing quite a stir between the supporters of the bill and those who oppose it. People in opposition to the new laws say they give too much power to the banks and other creditors. Those in support say it will make people more responsible with their spending habits and stop the abuse for declaring Chapter�7 bankruptcy to avoid paying owed debts. There are great points in support of both sides. Some good points to the new bankruptcy laws include some of the following. Any money that has been put into an educational IRA will not be affected by any bankruptcy proceedings. Credit counseling agencies and going to start being to stricter standards and will have to start meeting specific criteria in order for them to remain in operation. Companies that issue credit cards will also be held to stricter standards. They will soon be required to inform consumers just home long it would take to pay a balance off if just the minimum monthly payment is made. Also it will prevent the issuing company from closing your account should you only pay the minimum balance. Also studies will begin to see if these companies are issuing credit cards to individuals without taking into account if they are well enough equipped to repay any possible debt. Those in opposition to the new bankruptcy laws would more then likely bring up some of the following points. Debtors will risk loosing their vehicle to repossession if they are unable to pay the total cost of the auto loan even if the vehicle's worth is less then the outstanding balance. Debtors will soon be required to pay off all debts charged on credit cards the three months prior to filing bankruptcy. Landlords will have a much easier time evicting bankrupt tenants the have fallen behind on their rent. Courts will be able to spell out what is believed to be a reasonable amount to spend monthly on food, transportation and other monthly expenses. Unless a good reason not to is presented debtors will be required to live within these guidelines. Creditors will begin to have the power to ask the courts to end the bankruptcy petition should the debtor be late in filing any type of paperwork such as paycheck stubs. Whether you are in support or opposition of the new bankruptcy laws hopefully everyone will take them into consideration when deciding to make that next purchase on credit or signing up for that too good to be true credit card offer. |

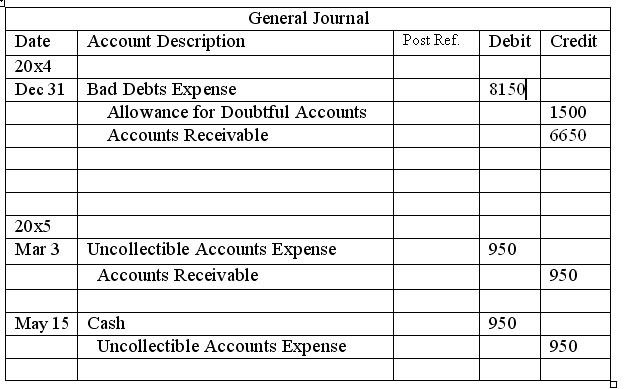

Image of bad debt expenses

bad debt expenses Image 1

bad debt expenses Image 2

bad debt expenses Image 3

bad debt expenses Image 4

bad debt expenses Image 5

Related blog with bad debt expenses

- quickbooksblog.blogspot.com/...enter the amount of the bad debt in the Amount of Discount field, and enter the name of your bad debt expense account in the Discount Account field. 7. Click Done in the Discount and Credits...

- studentlendinganalytics.typepad.com/...of the company fell nearly 3 percent on concerns about a rise in its bad debt expense."

- officehowto.blogspot.com/...the amount field here blank. Next, you want to record the tax-exclusive amount to the Bad Debts expense. To do this, you will enter the figure as a negative. Finally, to write back the GST...

- compuscan.wordpress.com/...you a financial cushion in case you suddenly have an unforeseeable increase in expenses. A bad debt is one that puts a considerable strain on your regular income and that...

- mgpaquin.blogspot.com/... back home, and with the huge debt hanging over their heads, the... and abused.” Some of the worst abuses occur in the forestry industry...

- zengersmag.blogspot.com/...accrue any more unnecessary debt, or make any more unnecessary spending expenses. There’s not one big... things worse rather than better...

- greenbriarpictureshows.blogspot.com/...play several times in The Bad and The Beautiful . One ...home of deceased, and debt-ridden "Hugo ...to have a little fun at his expense? The other crumbling...

- icedteatragedy.blogspot.com/...of her departments expenses claim, where she intentionally... off a big debt or she had ... doing. I mean bad habits are...

- democracyreform.blogspot.com/...gain. They tend to do the opposite, ie,deliver short term gain at the expense of long term pain. The growing government debt in the US and other democracies is a good example...

- christiangunslinger.blogspot.com/...not deductible as charitable contributions. Not paid for at taxpayer expense. Contributions from corporations or foreign nationals...

Related Video with bad debt expenses

bad debt expenses Video 1

bad debt expenses Video 2

bad debt expenses Video 3