About 'bad debt reserves'|... it’s such a bad idea to set an everyday...of staggering government debt and moribund economic growth ... us very little reserve strength to deal with crises...

In spite of warnings by financial experts persuading consumers to use credit wisely, many people continue to use credit immaturely and accumulate several thousands of dollars of debt. Although many homeowners explore various options of debt elimination, such as refinancing a mortgage or obtaining a home equity loan, the odds of accumulating new debt is high. Fortunately, there are ways to access potential credit dangers. Some people live in denial, arguing that their credit situation is "not so bad." However, before one can gain control of their debt, and prevent it from spiraling out of control, it is important to be realistic and recognize the tell-tale signs of debt and credit troubles. 1. Evaluate Debts How many debts are you carrying? Some debts are unavoidable such as mortgage loans, car payments, student loans, etc. For the most part, lenders consider these necessary debts. On the other hand, unnecessary debts account for credit cards, retail store accounts, gas cards, etc. Occasionally, it helps to tally all debt amounts. This can provide a clear-cut answer as to whether you are headed for a crash landing. Furthermore, take into consider the minimum monthly payments. Sadly, some people accumulate so much debt, that they are unable to pay the basic minimum. Next, evaluate your payment habits. Are the credit accounts maxed out? Do you submit late payments? 2. Spending Habits Some people develop shopping addictions once they obtain a credit card. This usually amounts to spending more than they can afford. When cash is not available, credit cards become a trusted friend. Credit cards serve a useful purpose. Unfortunately, some people have difficulty exercising self-control. 3. Cash Reserves Are you able to save money? Because of high debts and huge monthly payments, several people earning a good salary are unable to build a cash reserve. Paying off credit card balances each month is ideal. Still, credit card habits should not stand in the way of you building a nest egg. Instead of shopping, practice saving. 4. Minimum Payments Never pay only the minimum payments. By doing so, you will always remain in debt. Thus, if you can only afford to make minimum payments, or cannot afford payments altogether- stop using credit! This is how the debt trap begins. Remember: credit cards must be repaid. These are not magic cards. 5. Increased Anxiety Do you lose sleep because of debt? Does debt cause a lot of family tension? If so, you might consider creating a plan to lower your debt obligations. Use your home's equity to reduce debts, or seek help from a debt consolidation agency. |

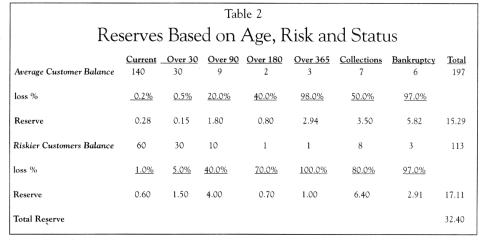

Image of bad debt reserves

bad debt reserves Image 1

bad debt reserves Image 2

bad debt reserves Image 3

bad debt reserves Image 4

bad debt reserves Image 5

Related blog with bad debt reserves

- openingmind.blogspot.com/...Denninger said the real amount of bad debts is probably 30 trillion ... made by the Federal Reserve printing money and giving...

- tomjconley.blogspot.com/...extent that without those reserves the central government would lack...different than transferring debt from the banks to the...central government. China can handle bad debts in the ...

- tlevs.blogspot.com/...lot of jobs, and with crushing debt, aren't in much of a position to do anything...ever ever wins, things get even worse; you could call it the cleveland syndrome . you...

- ibloga.blogspot.com/... it’s such a bad idea to set an everyday...of staggering government debt and moribund economic growth ... us very little reserve strength to deal with crises...

- yet-another-value-investing-blog.blogspot.com/... to increase their cash reserves in 06, MDC actually ...liquidity. Cash Position change less debt 06 RYL -40% PHM -16% DHI -27... may not be as bad as the press would lead you...

- sqwormsgreean.blogspot.com/...this means all cash reserves of the banks will have...repay any outstanding debts they already have. The bad debts will take out...

- thoughtsontheworld.wordpress.com/...the same as China’s foreign exchange reserves. Although the central government ... the problem of bad debts, it is still trying...

- zengersmag.blogspot.com/...that the Republican agenda of ceaseless public budget-cutting will make the economy worse, not better. “Virtually every economist will say the only way we’re going...

- thdrussell.blogspot.com/...the amount of money in existence at worst only equals debt, but mostly exceeds it... (such as the Federal Reserve System in the United ...

- greenbriarpictureshows.blogspot.com/...as it were? Somehow that scene in The Bad and The Beautiful does have a ring of...Vince. His biggest sneer is reserved for horror movies, presented...

Bad Debt Reserves - Blog Homepage Results

...with a significant external surplus, little debt and reserves of over a quater of GDP. So how come... things really that bad? I hope to comment on this shortly

...: Not just for the birds 14.09.11 Mish’s Global Economic Three Worst States to Conduct Business: California, New York, Illinois 20.09.11 Daily ...

Related Video with bad debt reserves

bad debt reserves Video 1

bad debt reserves Video 2

bad debt reserves Video 3